Table of Contents

The cost of your $30,000 surety bond will, in most cases, be a yearly premium in the 0.75%-2.5% range. This translates into payments between $225 and $750. This sum, however, applies to applicants with a good credit score. Bad credit applicants usually pay between 2.5% and 10%, i.e. between $750 and $3,000 a year.

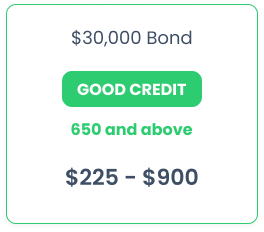

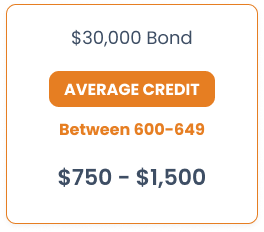

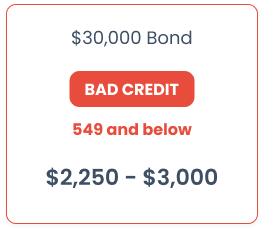

The table below contains a more detailed breakdown of costs:

Keep in mind that these are only estimations. You can receive a more exact quote once you submit our online application. Quotes are not only based on credit score, but factors such as the business’s financial strength and industry experience as well. Find out more in our surety bond cost guide.

Getting a $30,000 surety bond with bad credit

You can get a $30,000 surety bond even if you have bad credit, but– as the table shows– the lower your score, the higher your premium. If you have past due items or other red flags in your credit report, this can further impact your credit score.

However, in most cases you will still get bonded. If you are receiving a quote which you think may be too high, you can talk to one of our surety bond agents and they will happily provide personalized advice on how you can build a stronger application.

Most Common $30,000 Surety Bonds

Auto Dealer Bonds

Farm Labor Contractor Bonds

Health Club Bonds

Frequently Asked Questions

Still Have Questions?

Still haven't found the answer you are looking for?

Give us a call at 866.450.3412 or leave your question below.