Washington Contractor License Bond Requirements

The following types of contractors need to get a Washington state contractor license bond:

- General contractors require a $12,000 surety bond, and specialty contractors need a $6,000 bond that they must post to the Washington State Dept. of Labor & Industries (L&I).

- Electrical/telecommunication contractors must submit a $4,000 surety bond when applying for a license from the L&I.

- Fire sprinkler system contractors must submit a $6,000 bond for a level 1, level 2, and level I & T license. A $10,000 surety bond is required for a level 3 and level U license. The bond must be posted to the Washington State Patrol (WSP) when applying for a license.

- Farm labor contractors must submit a bond in an amount between $5,000 and $20,000 depending on the number of employees they have. The bond must be submitted to the L&I as part of the contractor license application.

- Sewer contractors in Seattle must post a $30,000 surety bond to the Department of Constructions & Inspections.

- Sewer contractors in Redmond must submit a $5,000 bond to the City of Redmond.

- Utility district sewer service contractors in the Lakehaven utility district need to obtain a $10,000 surety bond and post it to the Lakehaven water & sewer district.

There can be other counties and cities in the state that have special contractor license bond requirements. Bryant Surety Bonds is licensed to issue all types of contractor license bonds in the state of Washington. Complete our online application form to get a free instant quote.

Looking to get bonded in Washington for a construction project? See our contract bonds page for more information!

How Much Does a Contractor License Bond Cost in Washington?

The cost of your Washington contractor license bond is a small percentage of the required bond amount. This percentage is determined by the surety bond company issuing the bond on the basis of your personal credit score.

Prices start at $100 and applicants with a high credit score (700 FICO or higher) can be offered a premium of 1%-2%. For example, if you are a general contractor applying for a $12,000 surety bond and you receive a 1% quote, your annual costs will amount to $120.

For a ballpark estimate of your bond premium, see the table below.

| Washington Contractor License Bond Costs | |||||

| License type | Bond Amount | Surety Bond Cost by Credit Score | |||

| Above 700 | 650-699 | 600-649 | Below 599 | ||

| General contractor | $12,000 | $120-$240 | $180-$360 | $240-$480 | $360-$600 |

| Specialty contractor | $6,000 | $100 | $100-$151 | $120-$240 | $180-$300 |

| Electrical / telecommunications contractor | $4,000 | $100 | $100-$149 | $80-$160 | $120-$200 |

| Fire sprinkler system contractor level 1, level 2, and level I&T | $6,000 | $100 | $100-$151 | $120-$240 | $180-$300 |

| Fire sprinkler system contractor level 3, and level U | $10,000 | $100-$200 | $150-$300 | $200-$400 | $300-$500 |

| Farm labor contractor, 1-10 employees | $5,000 | $100 | $100-$150 | $100-$200 | $150-$250 |

| Farm labor contractor, 11-50 employees | $10,000 | $100-$200 | $150-$300 | $200-$400 | $300-$500 |

| Farm labor contractor, 51-100 employees | $15,000 | $150-$300 | $225-$450 | $300-$600 | $450-$750 |

| Farm labor contractor, 101 or more employees | $20,000 | $200-$400 | $300-$600 | $400-$800 | $600-$1,000 |

| City of Seattle Registered Side Sewer Contractor (RSSC) | $30,000 | $300-$600 | $450-$900 | $600-$1,200 | $900-$1,500 |

| City of Redmond Side Sewer Contractor | $5,000 | $100 | $100-$150 | $100-$200 | $150-$250 |

| Lakehaven Utility District Sewer Service Contractor Bond | $10,000 | $100-$200 | $150-$300 | $200-$400 | $300-$500 |

Apart from credit score, there are several other factors taken into account by the surety that can influence your bond premium. These are:

- Personal and business financial statements

- Fixed and liquid assets

- Work experience and record

By improving your score, along with any of the above, you can reduce the final cost of your contractor license bond.

To learn more about how bond premiums are formed, see our detailed surety bond cost guide!

General and Specialty Contractors

General and specialty contractors in Washington state are required to obtain a continuous contractor surety bond, under RCW 18.27.040. The bond coverage for general contractors is $12,000 and for specialty contractors is $6,000. According to this provision, the bond guarantees that the contractor will pay everyone who performs labor, provides materials or equipment for them. The bond also guarantees the payment of taxes to the state.

General and specialty contractors in Washington state are required to obtain a continuous contractor surety bond, under RCW 18.27.040. The bond coverage for general contractors is $12,000 and for specialty contractors is $6,000. According to this provision, the bond guarantees that the contractor will pay everyone who performs labor, provides materials or equipment for them. The bond also guarantees the payment of taxes to the state.

General and specialty contractors need to renew their surety bond every two years along with their contractor license.

With Bryant Surety Bonds, the price for a one-year surety bond for general contractors starts at $120 and for specialty contractors at $100. In some cases, the surety allows for a 25% reduction on the second year premium.

Electrical Contractors

Electrical contractors in Washington are required to obtain a $4,000 continuous surety bond, under RCW 19.28.04. The bond guarantees that electrical contractors will comply with building codes and ordinances when installing or maintaining wires or equipment that convey an electrical current. It also guarantees they will pay for all labor and materials, as well as pay taxes to the state.

Electrical contractors in Washington are required to obtain a $4,000 continuous surety bond, under RCW 19.28.04. The bond guarantees that electrical contractors will comply with building codes and ordinances when installing or maintaining wires or equipment that convey an electrical current. It also guarantees they will pay for all labor and materials, as well as pay taxes to the state.

Electrical contractors must renew their surety bond every two years along with their license.

Telecommunication contractors

Telecommunication contractors in Washington state are required to obtain a $4,000 contractor license bond issued for two years. The bond cost starts at $100 for applicants with a high credit score.

Under RCW 19.28.420, the bond guarantees that telecommunication contractors will pay for all labor, including employee benefits, as well as for any materials furnished or used during work. It also guarantees that the contractor will pay taxes to the state.

Fire protection sprinkler system contractors

Level 1, 2, and I&T Fire Protection Sprinkler System Contractors are required to submit a $6,000 surety bond.

Level 3 and U Fire Protection Sprinkler System Contractors are required to submit a $10,000 surety bond.

The surety bond for all types of fire protection sprinkler system contractors expires yearly on December 31. You must renew your license and bond prior to that date if you do not want your license to expire and be revoked.

A surety bond is required of fire protection sprinkler system contractors under the conditions specified in RCW 18.160.090. The regulation specifies that the contractor must pay compensation to their clients if they breach the conditions of their contract.

Farm Labor Contractors

Farm labor contractors are required to obtain a surety bond anywhere between $5,000 and $20,000 depending on the contractor’s number of employees.

The farm labor contractor license bond has a one-year term and expires on December 31. Contractors need to renew their bond yearly before the expiration date, otherwise, they risk losing their license.

A surety bond is required of farm labor contractors under RCW 19.30.040. The regulation states that “the bond shall be payable to the state of Washington and be conditioned on payment of sums legally owing under contract to an agricultural employee. The aggregate liability of the surety upon such bond for all claims which may arise thereunder shall not exceed the face amount of the bond.”

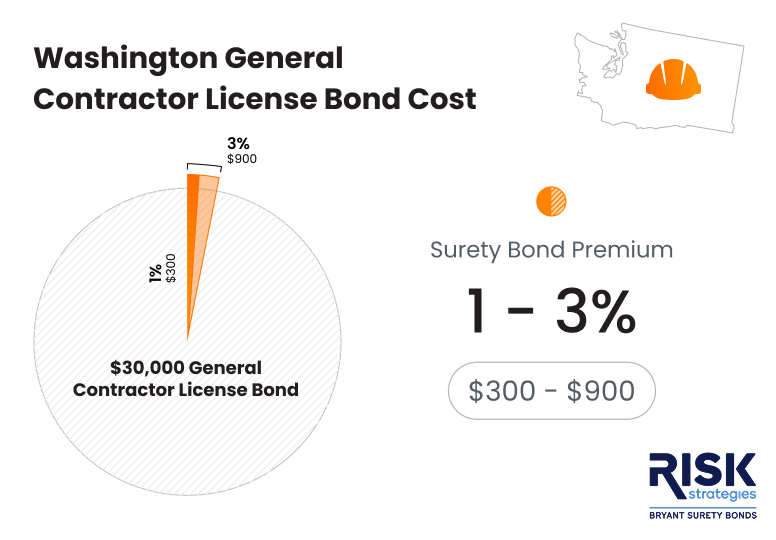

Seattle registered side sewer contractors

Sewer contractors in Seattle are required to post a $30,000 surety bond as part of the licensing process. According to Seattle Municipal Code (SMC) 21.16.060, the bond is “conditioned that the contractor shall replace and restore such street, alley, avenue or other public place as required by Section 21.16.280.”

Sewer contractors’ license bonds expire every three years from the date of the issuance, whereas the license needs to be renewed every year before December 31.

With Bryant Surety Bonds, the cost of a sewer contractor license bond starts at $300/year.

Redmond side sewer contractors

Redmond side sewer contractors must post a $5,000 surety bond when getting licensed.

Under the Redmond Municipal Code (RMC) 13.04.320, a contractor “shall be liable on his bond for any damage caused by his failure to properly protect and guard such excavation as herein required.”

Side sewer contractors in Redmond must renew their bond and license annually at the beginning of the year. Bonds and licenses expire at the end of January and must be renewed prior to that date.

Lakehaven utility district sewer service contractors

Lakehaven utility district sewer service contractors must post a $10,000 bond in order to operate in the district.

The bond is conditioned on the requirement that contractors comply with Lakehaven’s latest “Standards for Installation of Gravity Building/Side Sewers” as well as “Standards for Installation of Private Grinder Pump Systems, Pressure Side Sewers, and Private Force Main/discharge Pipelines from Grinder Pumps”.

Sewer service contractor licenses and bonds in the district are renewed annually and expire a year after the date of issuance.

Washington General and Specialty Contractor Licensing Requirements

To complete your general and specialty contractor licensing application, you need to take a few extra steps in addition to obtaining a contractor license bond. Some of them include:

- Register with the Washington Secretary of State (valid for LPs, LLCs, LLPs and corporations)

- Obtain a Uniform Business Identifier (UBI) number from the Department of Revenue

- Get an IRS Employer Identification Number (EIN), unless you are a sole proprietor with no employees

- Buy general liability insurance in an amount of $200,000 in public liability and $50,000 property damage, OR $250,000 combined single limit

- Fill out and notarize an Application for Contractor Registration

- Pay $117.90 license application fee - valid for 2 years

The Washington State Department of Labor and Industries has local representatives whom you can contact, to verify if you have satisfied all pre-licensing requirements.

Licensing requirements for other types of contractors in the state can vary depending on the license type.