Credit Services Organization Bond Overview

Credit services organization bonds are a pre-licensing requirement for credit service organizations (CSOs) in many states. Like other surety bonds, their purpose is to protect people who work with CSOs, as well as to make sure that all applicable regulations are upheld.

A typical bond agreement involves three parties: a principal (the CSO), an obligee (a state agency), and a surety (a bonding company). The surety underwrites the bond and guarantees to the obligee that the principal is financially trustworthy and capable of repaying potential claims.

A claim can be filed against the surety bond if the CSO breaches the bond agreement, which can have many forms. It’s important to be up-to-date with all new laws and regulations that can affect your industry, to minimize the likelihood of claims.

Keep reading the sections below for more detailed information on credit service organization bonds. If you have any questions, give us a call at 866.450.3412

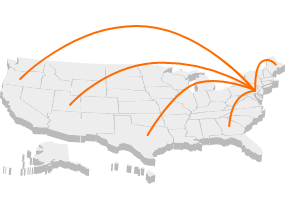

If you want to know how to get a credit services organization bond in your state, you can select your state below to see our detailed guides:

Credit Service Organization Bond Cost

The most important question most people ask is about the cost of their surety bond. In order to estimate your bonding cost, the first step is to get in touch with the state agency requiring your bond, to find out the required total value. A bond’s total value refers to the maximum protection the bond offers to claimants.

If the total value of your bond is $50,000, a potential claimant can get reimbursed for losses up to that amount. However, as the bond principal, you only pay a certain percentage of that sum, known as the bond premium. Premiums are paid annually or biannually, and their cost is determined by the bonding company. Before they underwrite each surety bond, bonding companies do an evaluation of an applicant’s credit report and financial situation to determine their likelihood of triggering and/or repaying a claim. Based on that information, they assign a premium.

For good credit applicants, premiums are generally between 1% and 5%. Check out our surety bond cost guide for more information on the factors determining your bond cost. You can also get a ballpark estimate using our free and quick surety bond cost calculator.

Credit Service Organization Bonds with Bad Credit

Unlike other types of surety bonds, applicants for credit service organization bonds are subject to more scrutiny than usual, especially if the total value of the bond is higher. Therefore, apart from your credit report, a surety underwriter may request that you also submit personal and business financial statements. They might also look into your work history.

Sometimes these additional details work in your favor, and can even reduce your premium. For example, if you have a lot of industry experience, this can somewhat offset a low credit score because it is considered a sign of trustworthiness.

Bad credit premiums for these bonds may go as high as 25%. Talk to one of our surety experts for some advice on how to strengthen your application and reduce your premium. Using our Bad Credit Program, you are guaranteed to get the lowest possible rate.

Apply for a Credit Service Organization Bond Today!

Our online application is only one page and will take you no more than five minutes to complete. At the end, we will give you a free bond quote which is based on the information you provide in the application, so the more you tell us, the more accurate our quote will be.

The underwriting process of each surety may vary, so we will let you know what documentation you will need to finalize your application.

After obtaining your bond, be sure to be on the lookout for regulatory changes concerning the industry, as surety bond claims are something to avoid at all costs.