Table of Contents

Surety Bond Definition

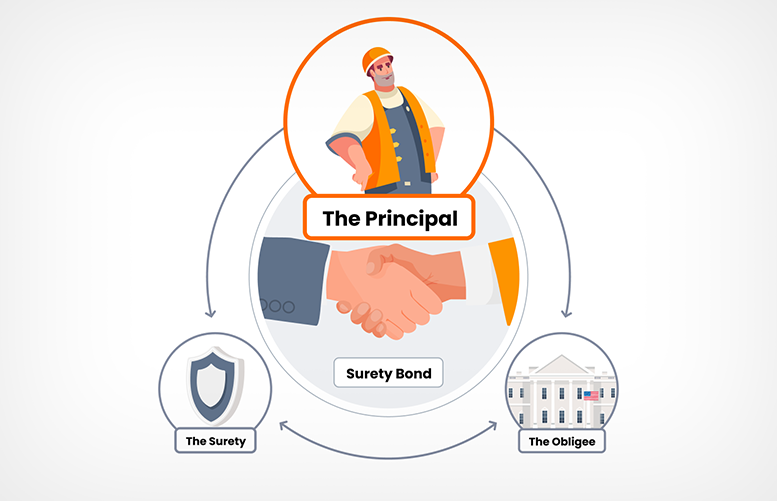

A surety bond (pronounced “shoo-ruh-tee”) is a legally binding agreement involving three parties—the Principal, the Obligee, and the Surety. In this agreement, the Surety provides a financial guarantee to the Obligee if the Principal defaults on their obligations, such as not being able to fulfill the terms of their contract or not complying with laws and regulations.

How Do Surety Bonds Work: The Three-Party Agreement

- The Principal: The individual or business that purchases the bond to guarantee future work performance.

- The Obligee: The party requiring the bond to protect against loss or non-performance. Typically, a government agency or a client.

- The Surety: The surety bond company that backs the bond and provides the financial guarantee to the obligee on behalf of the principal.

Surety Bond vs. Insurance: Understanding the Difference

Unlike insurance, a surety bond is not a two-party contractual agreement but a three-party guarantee. While insurance is designed to compensate the insured party for losses, a surety bond ensures the obligee is protected if the principal fails to fulfill their obligations.

Surety Bond Types and Examples

Surety bonds come in various types, each designed to serve specific requirements and industries. The main categories include:

- Contract Bonds: Used in the construction industry, ensuring contractors fulfill their contractual obligations. Examples include bid bonds, performance bonds, and payment bonds.

- Commercial Bonds (License & Permit Bonds): Required as part of the licensing process by government bodies for businesses in regulated industries to ensure compliance with laws and regulations. Examples are auto dealer bonds, freight broker bonds, and contractor license bonds.

- Court and Judicial Bonds: A court surety bond ensures that you will meet your obligations as mandated by legal, state, or federal courts. Examples include bail bonds, appeal bonds, and probate bonds.

- Fidelity Bonds: Protect your business and your clients from losses caused by fraudulent acts by employees. Examples include ERISA bonds, employee dishonesty bonds, and janitorial bonds.

Choose your state below to learn more your bonding requirements.

Choose Your State

- Select your state

-

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

How to Get a Surety Bond?

The Process of Getting Bonded

Obtaining a surety bond involves several steps, starting with identifying the bond type you need. Once you know your bond, the process includes the following simple steps:

- Apply: Submit an application to a surety bond agency, providing details about your business and the bond required.

- Approval: The surety then assesses your creditworthiness and risk.

- Get a quote: Once approved, you'll receive a quote for your bond.

- Get bonded: Upon payment, the bond is issued.

Generally, the process should be quick, often allowing for same-day approval and bond issuance depending on the bond type and the required information's readiness.

Choosing the Right Surety Bond Provider

When selecting a surety bond provider, consider their industry experience, financial stability, customer service, and the ease of the application process. Thanks to our partnerships with over 20 A-Rated, T-Listed markets, at Bryant Surety Bonds, we ensure a smooth process, competitive rates, and support throughout the bond's duration.

Online vs. Offline: Where to Apply for Your Surety Bond

While traditional, in-person applications are still an option, online applications have become increasingly popular due to their convenience and speed. Bryant Surety Bonds offers an easy-to-navigate online application process, making it simple to apply for and obtain the surety bond you need without leaving your desk.

Start your online application below and receive a free surety bond quote in minutes.

-

1Get a FREE Bond QuoteInstant ballpark estimateStart Your Application

-

2Tell us about your businesspowered by

-

3Get your FREE quote today!

Costs and Premiums: How Much Does a Surety Bond Cost?

The cost of a surety bond varies depending on the bond type, the bond amount, the principal's credit score, and other risk factors. Generally, premiums range from 1% to 15% of the bond amount. Improving your credit score and choosing a reputable surety bond provider can help reduce costs.

Factors Affecting Surety Bond Costs

- Bond Type: High-risk bonds typically have higher premiums.

- Bond Amount: Larger bonds have higher premiums.

- Credit Score: Applicants with high credit scores usually pay lower rates.

Tips for Reducing Your Surety Bond Premium

- Improve your credit score.

- Provide strong financial statements.

- Work with a reputable surety bond agency that can negotiate better rates on your behalf.

Frequently Asked Questions (FAQ)

Can I get a surety bond with bad credit?

Yes, but it may result in a higher premium. At Bryant Surety Bonds, we have a special high-risk program to help applicants with low credit scores get the best possible price for their bond.

How long does it take to get a surety bond?

It can vary, but with Bryant Surety Bonds, many bonds are approved and issued within 24 hours of application.

How long is a surety bond good for?

The duration of a surety bond can vary significantly depending on the type of bond and the specific requirements set by the obligee (the entity requiring the bond). Typically, surety bonds are issued for one-year terms from the date they are issued and may need to be renewed annually. However, some bonds have terms that last for multiple years or coincide with the duration of a contract or license period. It's important to review the terms of your specific bond agreement to understand the effective period and any conditions regarding renewal or extension.

Is a surety bond refundable?

No, once the premium is paid, it is not refundable, as it covers the risk the surety takes on behalf of the principal.

What is a surety bond amount?

A surety bond amount is the amount of financial guarantee provided by the surety (the company issuing the bond) to the obligee (the entity requiring the bond) that the principal (the individual or business purchasing the bond) will comply with the terms outlined in the bond. It is also known as the penal sum because it is the maximum amount of money that could be paid out under the bond's terms in case of a valid claim.

What happens if a claim is made against my surety bond?

If you fail to meet your obligations, a claim can be raised against your bond. The claim will be investigated, and if found to be valid, the surety will have to pay the obligee for any financial losses up to the bond amount. You will then have to reimburse the surety in full for any settled claims.

Visit our Surety Bond FAQ page to explore more information on common questions you may have, and feel free to reach out to us with any inquiries.

Frequently Asked Questions

Still Have Questions?

Still haven't found the answer you are looking for?

Give us a call at 866.450.3412 or leave your question below.