Table of Contents

It’s important to understand that the $75,000 amount is not the sum required to pay in order to get the surety bond. It only refers to the maximum penal sum of the bond, i.e the maximum compensation a claimant can get if their claim is proven.

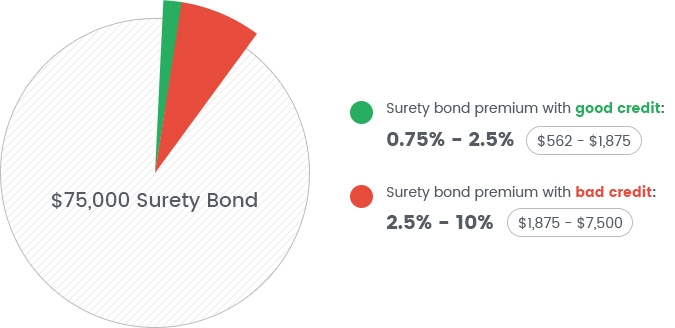

To get your surety bond you will have to pay a bond premium annually. There are several factors which will determine your premium. Without a doubt the most important among them is your personal credit score.

Applicants with a FICO score of 650 or above usually pay between 0.75% and 2.5%, while applicants with bad credit can expect premiums in the range of 2.5% to 10%. This means, a $75,000 surety bond will cost a good credit applicant somewhere between $562 and $1,875. For a bad credit applicant the cost will be in the range between $1,875 and $7,500.

Here is a breakdown of what your premiums are likely to be based on your credit score.

| Surety Bond Cost by Credit Score | ||||

|---|---|---|---|---|

| Surety Bond Amount | Above 700 | Between 650-699 | Between 600-649 | Below 599 |

| $75,000 | $562,5-$1,125 | $750-$1,875 | $1,875-$3,750 | $3,750-$7,500 |

If your credit score is poor, you can include additional information in your application which can positively affect your surety bond premium. For more information on bonding costs, as well as cost-saving tips, be sure to check out our How Much Does a Surety Bond Cost? guide.

Getting a $75,000 Surety Bond With Bad Credit

Applicants with bad credit have a hard time getting bonded, because a poor credit history (or no credit history) is associated with more risk for bond underwriters. However, obtaining a surety bond is still possible, albeit at a slightly higher premium.

Bryant Surety Bonds offers a bad credit surety bonds program, which can help you get bonded at a rate of 2.5% to 10%.

-

1Get a FREE Bond QuoteInstant ballpark estimateStart Your Application

-

2Tell us about your businesspowered by

-

3Get your FREE quote today!

How to Calculate Surety Bond Cost

Surety bond underwriting takes several factors into consideration before providing quotes. Business owners will be required to send financial statements, income tax returns, references from suppliers, proof of insurance, organizational charts, lists of past projects, and the resumes of key leaders within the company.

The surety company’s underwriters will verify these documents and ensure the applicant meets all the bond requirements. Then, the underwriter will consider experience, character, and credit history to calculate a premium.

The cost of the bond will also vary based on bond type and amount. Commercial bonds, such as permit or license bonds, usually require lower amounts than large, full-bond line projects. With a good credit score, bond applicants can typically receive a low rate, assuming little risk is involved.

To calculate your surety bond cost, start by taking a closer look at your FICO credit score. A typical applicant with good credit usually receives the best rates compared to an applicant with bad credit. If the applicant has a FICO score of 650 or more, they may be offered a rate between 0.75% and 2.5%. Applicants who score less than 650 can anticipate paying a premium between 2.5% and 10%.

For example, on a $75,000 surety bond, an applicant with good credit score might pay between $562 and $1,875. Someone with a bad score will typically pay between $1,875 and $7,500.

To get an idea of what premium to expect, use an online surety bond calculator. This useful tool can give you a free quote based on the type of bond, the state you are in, the amount, and your personal credit score.

Most Common $75,000 Surety Bonds

Here are some of the surety bonds that have a $75,000 amount:

Freight Broker Bonds

NVOCC Bond

Frequently Asked Questions

Still Have Questions?

Still haven't found the answer you are looking for?

Give us a call at 866.450.3412 or leave your question below.