Table of Contents

Contract bonds are surety bonds that a contractor will fulfill the terms of a contract. You will mostly come across these bonds in the construction industry. The terms “contract bond” and “construction bond” are interchangeable. If there are disruptions or events that hinder the completion of a project, the investor will benefit from the surety bond as they can recover their losses. Not only does the project owner benefit, but suppliers who fail to meet their mandate as per the contract specifications also get protection. Read on to learn more about these bonds.

What Is a Contract Bond?

Contract bonds are contractual obligations. They are an agreement drawn between three parties:

- The obligee – This is the project owner or the person who will receive the obligation of a contract.

- The principal – This is the party responsible for carrying out the obligation, in this case, the contractor.

- The surety – This is the party that assures the obligee that the principal will carry out their obligation according to the terms of the contract.

It's important to know how to get bonded for construction. Contractors (the principal) need to file contract bonds with the owner of the project during the bidding process for a project. These contract bonds have two categories; bid bonds that a contractor must submit to be allowed to submit a valid bid on a project and final bonds that contractors need to enter a contract. The surety in contract bonds is an insurance carrier licensed to operate in the state where the obligee needs the project handled. The insurance company that offers the bond can be referred to as the “bond company” or “surety company.”

How Do Contract Bonds Work?

Contract bonds protect the owner of a project in case there are events that hinder the completion of the project. The owner transfers their losses to the surety company. Construction contract bonds are requirements for construction projects on public properties. The federal government requires these bonds as stipulated in The Miller Act for contracts above $150,000. States also have their own requirements as stated in the Little Miller Act. These state acts are the same as the federal contract bond requirements.

Contract bonds may have two parts:

- One part that protects the project owner against failure to complete a project

- Another part that protects the owner against nonpayment for materials and labor

The project owner, the obligee, is the party that lists a project for contractors to bid on. They require the surety bond to minimize the losses they may experience in case of incompletion. When the contractor, the principal, submits a contract bond, they are promising that they will complete the job according to the contract. The principal is stating that they have the financial muscle to complete a project to the highest degree of quality specified in the contract.

If the contractor fails to meet the terms of the contract, the owner will make a claim against the bond to get compensation for any financial losses. A contractor can default or declare bankruptcy, and this is where the contract bond comes in to pay the project owner.

Before a contract bond is written, the company that gets the bond has to:

- Review the requirements of the project to see if a bond is necessary

- Get a bid bond from an agent from the surety company and submit it with their bid for the contract

- If they win the bid, they will go back to the surety company for a performance bond

- Complete the project

- Apply for a maintenance bond that may be needed for any repairs after project completion

How Much Does a Contract Bond Cost?

Contract surety bonds will take between 1% and 3% of the total contract amount. Factors, such as the size of the project and the reputation of the contractor will determine how much money goes to the bond. The size of the bond will also determine the cost. For instance, contractors that get a bond of about $500,000 will pay about 3% of the contract amount.

If a contractor needs a larger bond, they will have to pay based on the bond size through a tiered model. A tiered bond rate of 25/15/10 is common where the contractor pays 2.5% for the first $100,000, 1.5% for the $400,000 above the first amount, and 1% for the rest of the money. This means that the payment rate is lower for contractors taking on huge projects.

If, for instance, you take a $1,000,000 contract bond, you may pay as follows:

- First $100,000 at 2.5% = $2,500

- Next $400,000 at 1.5% = $6,000

- Rest $500,000 at 1% = $5,000

The total cost of the contract bond in the case above will be $13,500.

Estimate how much your surety bond will cost to you with our free bond cost calculator.

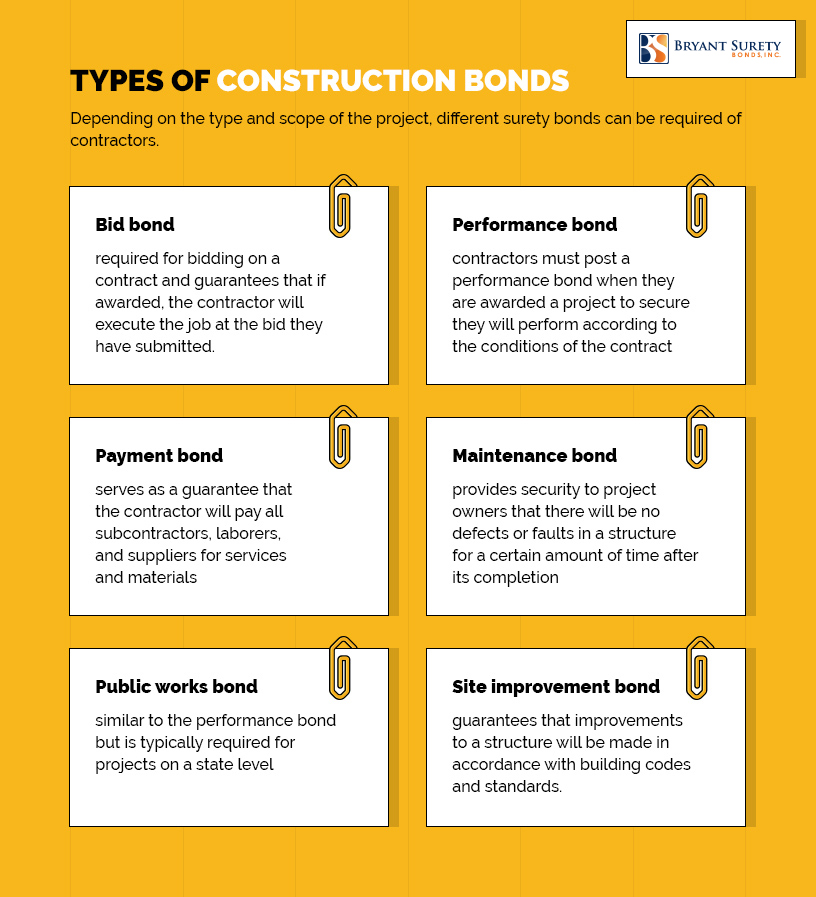

What Are the Types of Contract Bonds?

There are different types of surety bonds for contracts, including:

- Bid Bond – This is needed when the contractor submits a bid for a contract. If a contractor’s bid wins and they reject the job, the project owner can make a claim to collect the difference between the contractor’s original bid and the highest bid.

- Contractor License Bond – This is a license and permit bond that contractors need as assurance that they will follow all set rules and regulations. A contractor needs this bond to apply for contractor licensing.

- Maintenance Bond – This is a bond that protects the project owner against defective materials and poor workmanship. It comes after the completion of a project and can pay for any needed repairs to meet the terms of the project contract.

- Payment Bond – This is a bond that assures subcontractors that they will get payment for services delivered in the event that the contractor defaults on a project. The bond amount will reimburse the workers when the principal is not able to.

- Performance Bond – This is a bond that assures the developer that the contractor will complete the project. If they fail to do so, the developer will make a claim to access funds that can pay another contractor to complete the project. Performance bonds are necessary for all federal projects over $100,000, according to The Federal Miller Act.

- Site Improvement Bond – This is a bond that assures the completion of renovation and improvement projects.

Why Do I Need a Contract Bond?

If you plan to bid on projects over $100,000, the law requires that you have a contract bond. As a contractor, you also want to bid on projects where developers require a contract bond. Reputable contractors will find it easy to acquire the bond. However, even new contractors need the bond as an assurance that they will take the project to completion. As a developer, requesting a contract bond is the surest way to ensure that you do not run into losses.

Frequently Asked Questions

Still Have Questions?

Still haven't found the answer you are looking for?

Give us a call at 866.450.3412 or leave your question below.