It should come as no surprise that the overwhelming majority of large-scale public works and infrastructure construction projects have detailed bid proposals that require construction companies to be fully bonded before they bid for jobs. The request for proposals (RFP) will require bonds to protect the project owner from any financial loss caused by negligence or shoddy workmanship or if the contractor defaults. You’ll usually also need to be bonded for a private project. The good news is that the bonding process is pretty straightforward, and it's a common requirement in the construction industry. Here’s a quick look at how construction surety bonds work and how to get bonded.

What Is a Construction Bond?

Surety bonds for contractors are easy enough to explain. They’re a legally binding agreement between the project owner (aka the bond obligee), the contractor (aka the bond principal), and the surety company. The surety company issues and backs the bond as long as the bond principal meets the terms of the contract and/or the bond agreement. There are different types of construction bonds for different projects, but all surety bonds serve the same essential purpose. Both private companies and the government use a bond as protection against financial losses in the event of malfeasance. The obligee can proceed with confidence, and the bond principal can bid for lucrative projects.

Public obligees like state and federal governments will have clearly defined legal standards and conditions that must be met in order to qualify for contracts. A surety bond prequalifies you to bid for public work projects as soon as they’re announced, but you’ll want to carefully review all of the terms and conditions of the RFP to make sure that your existing surety bond line will be sufficient. The Miller Act requires surety bonds for all federal public works projects over $100,000, and each state government has similar requirements. You can find your state’s requirements by contacting your secretary of state.

Private entities and general contractors hiring subcontractors can also require surety bonds. The project owner determines their own terms and conditions to qualify for the project, and those conditions will likely be very similar to the conditions set forth on a government project. Be sure to review the RFP thoroughly before bidding on any private projects to determine the bonding requirements.

How Do Construction Bonds Work?

A construction bond protects the bond obligee. The contractor has to meet certain criteria to qualify and pays a premium based on the job size/bond amount. We’ll be discussing some of those criteria in more detail in an upcoming section, but they include having sufficient experience, good finances, and good credit. If you have bad credit or cash flow problems, you might need to get those resolved before you can purchase a surety bond for construction projects. Fortunately, if you’re a seasoned contractor with a strong business, the underwriters will consider those factors to determine the overall financial health of your construction business.

Surety bonds give property owners peace of mind. In the event of an issue, the bond obligee can file a claim directly with the surety company to recoup their losses.

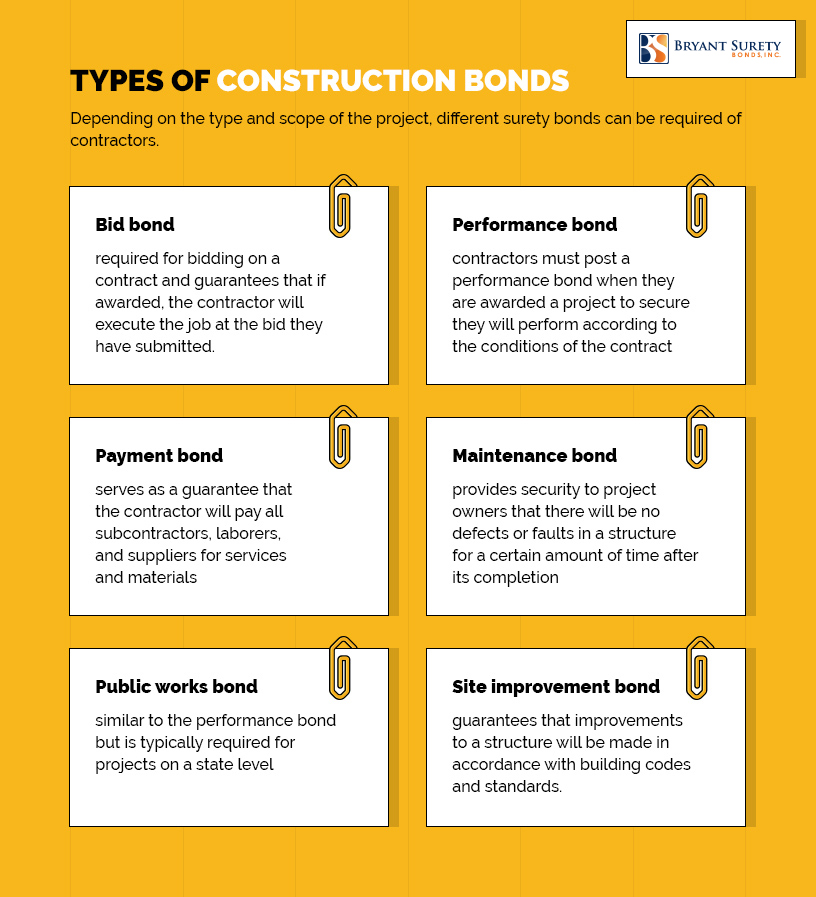

Types of Construction Bonds

There are three main categories of construction bonds, which are outlined below. You will obtain them from the same surety bond company, and the bid bond prequalifies you for the other two types of bonds. You might hear the term construction bond used interchangeably for all three types of bonds, but they cover different aspects of the project.

- Bid Bonds - Almost all large public works and infrastructure projects will require a bid bond, which reassures the obligee that the bonded contractor is sufficiently qualified to meet the requirements set forth in the RFP. Obtaining a bid bond ensures the obligee that your bid is complete and accurate and that you’ll be provided both a performance bond and a payment bond in the event that you and your company are awarded the contract.

- Performance Bonds - Your performance bond is your guarantee to the owner that you will complete the required work according to the terms of your contract. The wording of the contract will have specific agreed-upon deadlines and standards, and the performance bond will reflect those expectations. In addition to meeting the agreed on timeline and delivery deadlines, the contract will also have stipulations for materials and any location-specific logistical issues. If the contractor fails to meet the deadlines or quality standards, the performance bond protects the bond obligee from the resulting financial losses.

- Payment Bonds - In addition to protecting the property owner, your payment bond also guarantees that all subcontractors, suppliers, and tradesmen will be paid. The general contractor has a fiduciary obligation to compensate employees and subcontractors, and the payment bond holds the contractors accountable. The Miller Act requires federal contractors to obtain a bond for projects over $1,000, and anyone who hasn’t been paid can file a claim against the bond. A Miller Act claim works in the same fashion as a mechanic's lien and can delay payment for the job to the general contractor until payment issues are resolved with the relevant stakeholders in the project.

Other Construction Bond Categories

In addition to your bid bond, performance bond, and payment bond, the property owner might also require you to obtain certain types of specialty bonds.

- Maintenance Bonds - Your maintenance bond is your warranty for your work. Be sure to specify a termination period for the warranty, with the option to renew or renegotiate at the conclusion of the warranty period.

- Supply Bonds - Supply bonds are an important way to ensure that all of your suppliers deliver the materials that you need according to the terms of the contract. Supply chain problems are becoming increasingly more prevalent, and this trend is only likely to continue changing. A supply bond is a good way to protect your investment when the job falls victim to logistical issues that are beyond your control.

- Subdivision Bonds - Many communities have very specific regulations and guidelines that need to be followed. This might include standards for zoning, signage, and materials. A subdivision bond is a special construction surety bond category that can serve as a contractor’s guarantee that the public works or infrastructure improvements will be completed to the required standards and within an explicitly stated required timeframe.

- Site Improvement Bonds - All reputable contractors are familiar with the concept of service after the sale, and a site improvement bond is your guarantee that scheduled improvements will be completed on schedule and within budget. Be sure to consider the long-term needs of all public works projects when submitting your bid package to the property owner.

Construction Bond Requirements

Each commercial and municipal construction contract will have different requirements, which will include the amount of the construction bond and the project deadline. The obligee will decide the terms of the bond and disclose them in their RFP, and it’s your job as the general contractor to meet those terms. The surety bond agency will work with you to help you meet those requirements so that you can submit a qualified bid package. The bond issuer cannot assist you with financial planning, but it always pays to take a good look at the overall financial health of your business as you begin the process of obtaining your construction bond.

Costs of Construction Bonds

In order to determine the premium of a commercial bond, you’ll need to start with the contract amount or bond amount. Then, you must go through the underwriting and approval process. A bonding company will use risk to determine the cost of your loan and to determine its bonding capacity. Bonding capacity is like a credit limit, and it often includes a single limit for individual projects and an aggregate limit, which is a lifetime maximum total.

The surety company underwriters will do a credit check and look at your company’s financial statements to determine your underwriting risk. Underwriters have very specific standards that they must follow to make their decisions, and they can’t deviate from them. But most underwriters are interested in finding ways to help applicants qualify, and they will always consider your experience.

You can expect to get better rates if you have good credit, but you won’t automatically be disqualified if you have rough patches in your credit history. If you're a seasoned contractor with good cash flow and steady work lined up for the future, the underwriters will always keep that in mind. Bond premiums are also determined by geographical location and the risk profile of different types of construction work.

How to Get a Construction Bond

In order to obtain a construction bond, you’ll need to go through a few basic steps.

- Locate RFPs and look for the bond requirements in the job specifications. Public projects and commercial projects will almost always require contractors to be bonded, but the requirements might be different for different types of projects.

- Contact your surety company to obtain a bid bond and submit your bid bond with your bid package to the property owner.

- Notify your bond agent of bid results. If you didn’t win the bid, notifying your bid agent will free up your bonding capacity so that you can bid on future RFPs right away.

- If you are awarded the project, the next step will be to contact your bond agent and request a performance bond.

- Complete all of the work on the project in accordance with the contract terms.

- Once you’ve completed the work, notify your bond agent so that you can free up your bond capacity.

- You might also need a maintenance bond after you’ve closed out the job and performance bonds for the scheduled upgrades.

The bond application requirements will vary according to the amount of the bond, the details of the project, and the surety company that issues the bond. If the bond amount is under $250,000, applying for the bond will typically involve submitting an application for a quick form contract bond. The bond application will include details about the bond requirements, and you’ll need to go through a quick business credit check. You might also have to submit additional documentation during the underwriting process.

If the bond is larger than $250,000, the application process will be much more detailed. Underwriters at the surety agency will evaluate your bond worthiness, including your credit score and current financial statements. Negative credit and bankruptcies can haunt your business for a long time, so be sure to actively monitor your credit score and respond to all errors in a timely fashion.

Once the underwriting process is complete, the surety company will calculate a bond price, which is typically a small percentage of the bond's total value. Once you pay your first premium, your surety agency will provide you with the documentation that you require to bid for lucrative commercial and public works projects.

How to Find the Right Bond Company

When it comes to finding a surety company to issue the contractor license bond and your bid bond for your construction company, you owe it to yourself to do your research and find a company that you can trust. Our team at Bryant Surety Bonds is always a mouse click or phone call away when you have any questions. We underwrite all types of construction bonds for commercial and infrastructure projects in all states at great rates, and our commitment to legendary service is second to none. Apply now for a free quote!