Table of Contents

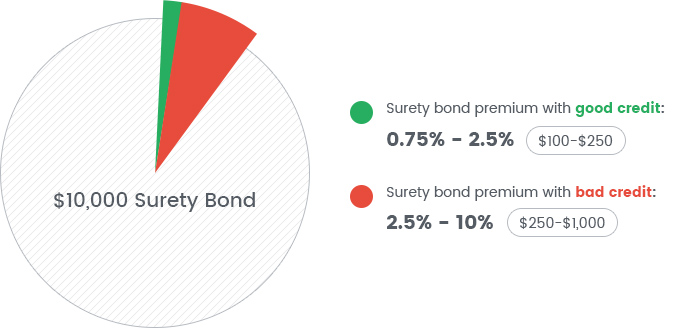

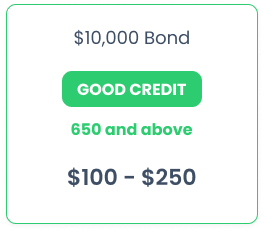

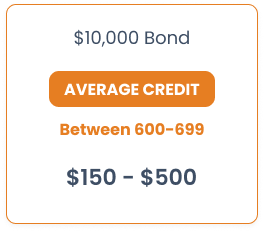

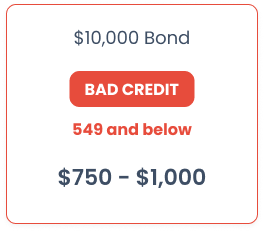

You can get the exact price of your $10,000 only after a bond underwriter has reviewed your application, but you can get a ballpark estimate based on your credit score. Applicants with good credit (above 650) mostly pay premiums in the range of 0.75% to 2.5%, which translates into annual payments between $100 and $250. Bad credit applicants, on the other hand, can expect a premium between 2.5% and 10% or $250 to $1000 annually.

Keep in mind that these are rough estimates and some exceptions apply, as is the case with contract bonds, whose premiums can often exceed 10% because they are considered high risk by bonding companies.

The table below contains a bit more detailed information on expected premiums based on four different credit score brackets.

You credit score is undoubtedly the most important determinant of your surety bond cost. However, several other factors can also play an important role, especially when taken together. Consult our How Much Does a Surety Bond Cost? guide for some useful tips and information about reducing your premiums.

How to get a $10,000 surety bond with bad credit

Obtaining a surety bond with bad credit can be a bit more difficult because some bonding companies are unwilling to assume the higher risk that they imply.

To help applicants who struggle with their credit history, we offer the Bad Credit Program, thanks to which applicants get access to the strongest bond providers in the U.S. If you are worried about the high cost of getting bonded with bad credit, our surety agents can help you make your application stronger before you submit it to underwriters.

Most Common $10,000 Surety Bonds

Motor Vehicle Dealer Bonds

Contractor License Bonds

Frequently Asked Questions

Still Have Questions?

Still haven't found the answer you are looking for?

Give us a call at 866.450.3412 or leave your question below.