Table of Contents

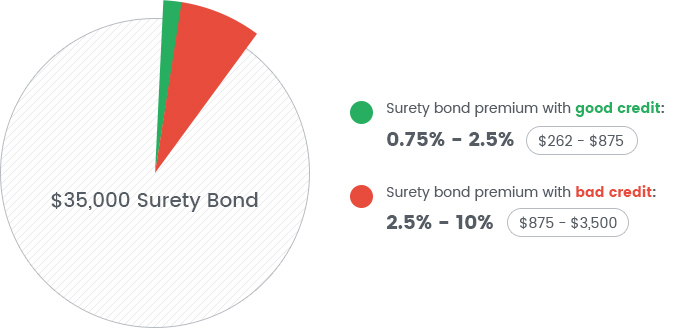

The cost of a $35,000 surety bond depends on several factors, the most important of which is the applicant’s credit score. While getting an exact price is only possible after submitting an application, you can get a rough estimate beforehand. Applicants with good credit usually pay premiums between 0.75% and 2.5%, which translates into payments of $262 - $875 a year. Bad credit applicants can rarely see their premium exceed 10%, so their yearly costs vary between $875 and $3,500. Premiums for contract bonds where the risk for the underwriter is higher, can exceed 10% more often.

The table below contains a more detailed breakdown based on the credit score bracket you are in.

| Surety Bond Cost by Credit Score | ||||

|---|---|---|---|---|

| Surety Bond Amount | Above 700 | Between 650-699 | Between 600-649 | Below 599 |

| $35,000 | $262,5-$525 | $350-$875 | $875-$1,750 | $1,750-$3,500 |

Although very important, personal credit score is not always the only determinant of an applicant’s surety bond premium. Other factors such as industry experience, financial strength, even the choice of a surety agency, can all influence bonding costs. Read our our How Much Does a Surety Bond Cost? guide where we provide a lot of valuable tips that can help you cut your costs.

Getting a $35,000 surety bond with bad credit

Getting bonded with bad credit is usually more difficult, because sureties assume a higher risk when underwriting bonds for applicants with poor credit, credit history issues or even no credit history at all.

We have designed our Bad Credit Program, so we can help applicants with credit issues get bonded with a 99% success rate. Only on rare occasions, such as if you have an open bankruptcy or are late on your child support payments, will you be denied a bond because of your credit.

As mentioned in the beginning, your premiums will rarely exceed 10% even if you have bad credit and you can take steps to reduce it further when renewal is due.

Most Common $35,000 Surety Bonds

Frequently Asked Questions

Still Have Questions?

Still haven't found the answer you are looking for?

Give us a call at 866.450.3412 or leave your question below.