Table of Contents

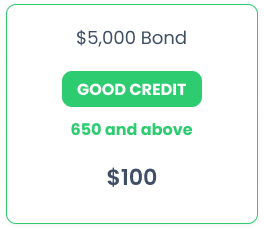

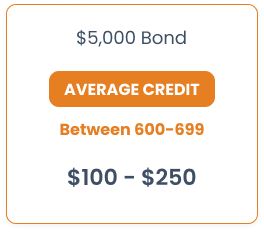

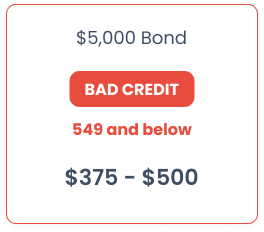

A $5,000 surety bond can cost as little as $100 for applicants with a good credit score, or go as high as $500 for applicants with bad credit.

For more detailed information, you can consult the table below:

As you can see, premiums for applicants with good credit are no more than 2.5%. Costs can go as high as 10% for applicants with a credit score lower than 600. Remember, however, that these are only estimates. Premiums can be changed based on each applicant’s information that’s provided to the surety underwriter.

Factors such as financial strength, years of operation and past claims can all affect your premium. You can learn all about it in our surety bond cost guide.

Can I get a $5,000 surety bond if I have bad credit?

Applicants with bad credit are usually subject to more stringent underwriting consideration. However, since $5,000 surety bonds do not pose a huge financial risk for bonding companies, the majority of applicants will be able to get bonded without any problems.

If you work to improve your credit score, and clear past due items from your credit report, you can gradually see your bonding costs go down.

-

1Get a FREE Bond QuoteInstant ballpark estimateStart Your Application

-

2Tell us about your businesspowered by

-

3Get your FREE quote today!

Most Common $5,000 Surety Bonds

Auto Dealer Bonds

Tax Preparer Bonds

Farm Labor Contractor Bonds

Contractor License Bonds

Frequently Asked Questions

Still Have Questions?

Still haven't found the answer you are looking for?

Give us a call at 866.450.3412 or leave your question below.