Oregon Contractors License Bond Requirements

There are three main types of contractor license bonds that are required in Oregon. These are:

-

Residential contractor license bonds - several different types of bonds are required in Oregon, depending on the type of residential license. These bonds must be posted to the CCB.

- Residential general contractor: $20,000

- Residential specialty contractor: $15,000

- Residential limited contractor: $10,000

- Residential developer: $20,000

- Home services contractor: $10,000

- Residential locksmith services contractor: $10,000

- Home inspector services contractor: $10,000

- Home performance score contractor: $10,000

-

Commercial contractor license bonds - commercial contractors in the state must also get bonded. Bond amounts differ according to the type of license being applied for. These bonds must also be submitted to the CCB.

- Commercial general contractor level 1: $75,000

- Commercial general contractor level 2: $20,000

- Commercial specialty contractor level 1: $50,000

- Commercial specialty contractor level 2: $20,000

- Commercial developer: $20,000

-

Landscape contracting business license bond - landscape contractors must post a bond in an amount that is dependent on how much they charge over the course of one year. This bond must be submitted to the LCB as part of the license application. Bonds are in the following amounts:

- $3,000 bond for jobs up to and including $10,000

- $10,000 bond for jobs of more than $10,000 but less than $25,000

- $15,000 bond for jobs of more than $25,000 but less than $50,000 or for a probationary license

- $20,000 bond for jobs of $50,000 or greater These are the various types of contractors license bonds required in the state of Oregon. Bryant Surety Bonds is able to offer instant quotes for all contractor license bonds. This means contractors can apply, buy, and print their bonds in minutes.

To get started, complete the online application form and we will shortly provide you with your free quote.

Do you need an Oregon contract bond instead? Visit our contract bonds page for a full list of the contract bonds available through Bryant Surety Bonds!

Get a quick estimate of the cost of your bond by using our surety bond calculator below!

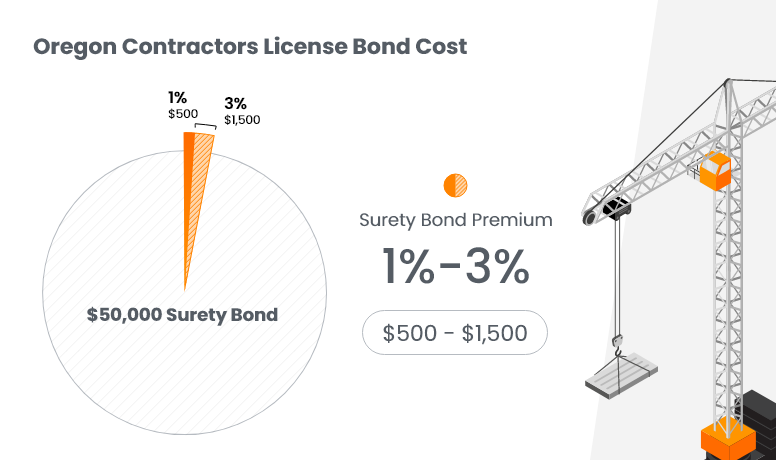

How Much Does an Oregon Contractors License Bond Cost?

The cost of getting bonded as an Oregon contractor is equal to a percentage of the total bond amount. The most important factor that sureties take into account when setting a bond rate is an applicant’s personal credit score.

If an applicant has a high credit score (700 FICO or above), they can expect to be offered a rate of 1% or 2% of the total bond amount. So, for example, if you need a $15,000 bond and are offered a 1% rate on your bond, you will need to pay $150 to get bonded.

Wondering how much your Oregon contractors license bond might cost? See the table below for a ballpark estimate!

| Oregon Contractors License Bond Costs | |||||

| License type | Bond Amount | Surety Bond Cost by Credit Score | |||

| Above 700 | 650-699 | 600-649 | Below 599 | ||

| Residential contractor license bonds | |||||

| Residential limited contractor, Home services contractor, Residential locksmith services contractor, Home inspector services contractor, Home performance score contractor | $10,000 | $100-$200 | $150-$300 | $200-$400 | $300-$500 |

| Residential specialty contractor | $15,000 | $150-$300 | $225-$450 | $300-$600 | $450-$750 |

| Residential general contractor | $20,000 | $200-$400 | $300-$600 | $400-$800 | $600-$1,000 |

| Commercial contractor license bonds | |||||

| Commercial general contractor level 2, Commercial specialty contractor level 2, Commercial developer | $20,000 | $200-$400 | $300-$600 | $400-$800 | $600-$1,000 |

| Commercial specialty contractor level 1 | $50,000 | $500-$1,000 | $750-$1,500 | $1,000-$2,000 | $1,500-$2,500 |

| Commercial general contractor level 1 | $75,000 | $750-$1,500 | $1,125-$2,250 | $1,500-$3,000 | $2,250-$3,750 |

| Landscape contracting business license bond | |||||

| For jobs up to and including $10,000 | $3,000 | $100 | $100-$149 | $60-$120 | $90-$150 |

| For jobs of more than $10,000 but less than $25,000 | $10,000 | $100-$200 | $150-$300 | $200-$400 | $300-$500 |

| For jobs of more than $25,000 but less than $50,000 or for a probationary license | $15,000 | $150-$300 | $225-$450 | $300-$600 | $450-$750 |

| For jobs of $50,000 or greater | $20,000 | $200-$400 | $300-$600 | $400-$800 | $600-$1,000 |

On top of credit score, sureties will also take into account other financial factors to set an applicant’s bond rate. These factors are:

- Personal and business financial statements

- Fixed and liquid assets

- Work experience and record

To get a better bond rate, you should primarily focus on improving your credit score. Improving your other finances can also be beneficial.

Learn more about how sureties set your bond rate from our surety bond cost guide!

Residential and Commercial Contractors

Under Oregon Revised Statutes (ORS) Chapter 701, all residential and commercial contractors must post a surety bond to get licensed. Bond amounts for these contractors vary according to their license classification and level.

For residential contractors, bonds are in amounts of either $10,000, $15,000 or $20,000. Commercial contractors must obtain a bond in an amount of $20,000, $50,000 or $75,000.

Bonds for both residential and commercial contractors guarantee that determination orders of the Construction Contractors Board (CCB) in accordance with ORS Chapter 701 will be paid.

According to Chapter 812 of the Oregon Administrative Rules (OAR), bonds and licenses for these types of contractors are valid for two years.

Landscape Contractors

Under ORS 671.690, landscape contracting businesses in Oregon must obtain a bond as part of the licensing process. That bond must be in an amount of $3,000, $10,000, $15,000, or $20,000. The amount depends on the total dollar amount they have charged or expect to charge on contracts for a year.

The purpose of this bond is to guarantee payment on any determination orders made by the Landscape Contractors Board (LCB), under ORS 671.690 through ORS 671.710.

Landscape contractor business licenses and bonds are valid for one year.

Oregon Contractor Licensing Requirements

To get a license, Oregon residential and commercial contractors must apply at the CCB. The licensing process for these contractors (regardless of their license classification) includes the following requirements:

- Select a license classification based on the type of structure that you will work on

- Complete a pre-licensing training course

- Pass a contractor license exam

- Register a business entity at the Oregon Secretary of State

- Obtain general liability insurance and workers’ compensation insurance (if you intend to hire employees)

- Get an Oregon contractors license bond

- Apply for state and federal tax numbers (if applicable)

- Complete a residential, commercial, or dual contractor license application

- Pay a $250 two-year license fee and submit your application documents

For any questions about the residential and commercial contractor license application process, get in touch with a CCB representative at 503-378-4621 or [email protected].

If instead, you wish to obtain a landscape contracting business license from the LCB, you must meet the following requirements:

- Register a business entity with the Oregon Secretary of State

- Apply for tax numbers from the IRS and the Oregon Department of Revenue (if necessary)

- Obtain a liability insurance policy, and a workers’ compensation insurance (if you will have employees)

- Get an Oregon contractors license bond

- Submit your contractor license application on paper or online, along with a $600 fee ($255 application fee + $345 license fee)

For any additional questions about the licensing process, contact the CLB at 503.967.6291 or [email protected].