Table of Contents

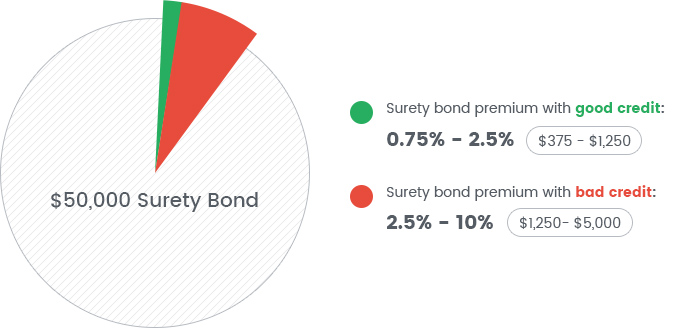

The cost of your $50,000 surety bond depends mostly on your personal credit score. Applicants with good credit usually pay premiums between 0.75% and 2.5%, which means between $375 and $1,250 per year. Applicants with bad credit, on the other hand, pay premiums in the range of 2.5% to 10%, or between $1,250 and $5,000.

As you see the $50,000 amount is not the sum required from the holder of the surety bond. Instead, this is the amount up to which a claimant on the bond can get compensated. The table below provides more estimates based on the credit score bracket you are in.

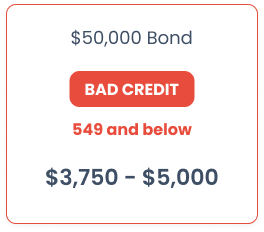

If you have bad credit, you might want to consider submitting additional information along with your application. Industry experience, strong financials or liquid assets can all contribute to a lower premium despite a less-than-stellar credit score. Check out our tips in our How Much Does a Surety Bond Cost? guide.

Getting a $50,000 Surety Bond With Bad Credit

Applicants with poor credit or other issues in their credit report are considered high risk, which is why certain bonding companies refuse to underwrite bad credit surety bonds.

For this reason, we have created our Bad Credit Program thanks to which 99% of applicants obtain the surety bond they need. Premiums are higher, but our surety bond experts can help you lower them as much as possible. Taking active steps to improve your credit reports can help you get a lower premium when bond renewal is due.

-

1Get a FREE Bond QuoteInstant ballpark estimateStart Your Application

-

2Tell us about your businesspowered by

-

3Get your FREE quote today!

How to Calculate $50,000 Surety Bond Cost

Whether it's $50,000 or another level for your commercial bonds, the real question is, how much does a surety bond cost? Don't let the $50,000 figure scare you. You don't have to pay that to get your surety bond. Instead, you can submit applications to bond companies that review your credit and various pieces of underwriting information to decide what they can offer you.

The bond premium is how much money you need to pay in advance. The penal sum, on the other hand, is the total amount of the bond. That's the maximum your surety company would pay for any valid bond claim.

When evaluating your application, a bond company will look at other pieces of information that you provide in addition to credit scores and reports, such as:

- Your résumé

- Working capital and assets

- Company phone number, address, and entity structure

- Completed projects

- Bank references

- Other references

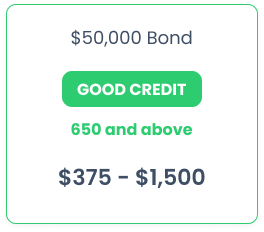

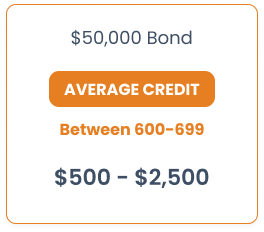

Specific rates for your surety bond will still vary the most based on your personal credit score. The following are ballpark figures, but they give you a good place to start:

- 599 and lower: 5% up to 10% / $2,500 up to $5,000

- 600 through 649: 2.5% up to 5% / $1,250 up to $2,500

- 650 through 699: 1% up to 2.5% / $500 up to $1,250

- 700 or higher: 0.75% up to 1.5% / $275 up to $750

Most Common $50,000 Surety Bonds

There are a lot of different types of surety bonds which require a $50,000 total bond amount. Here is a list of the most popular ones:

Auto Dealer Bonds

Contractor License Bonds

Mortgage Broker Bonds

DMEPOS Surety Bond

Telemarketing Bond

Frequently Asked Questions

Still Have Questions?

Still haven't found the answer you are looking for?

Give us a call at 866.450.3412 or leave your question below.